how does retirement annuity reduce tax

Ad Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment. At retirement the lump sum benefit is tax free up to a specified limit.

Retirement Calculator Spreadsheet Retirement Calculator Savings Calculator Annuity Retirement

An annuity is an insurance product that pays out income and can be used as part of a retirement strategy.

. When using a qualified annuity such as one in an employers retirement plan or a traditional IRA the contributions you make typically reduce your taxable income for the year in. It also includes any interest income above R23 400 and any net rental income. A fixed annuity is a contract between an investor and an insurance company.

If your company does not have a retirement fund all your income will be non-pensionable. Learn some startling facts. Managing your income by using the right mix of investments and annuities in retirement could help you trim your retirement tax rate to under 10.

Contributions to a designated Roth 401k account or Roth IRA are federally tax-free when you withdraw those funds as are the earnings assuming the withdrawal is a qualified distribution. If you buy your annuity using money from a regular savings or money market account or from a taxable brokerage account you do not have to pay taxes on withdrawals or. IRA and 401k owners over the age of 72 must take an annual required minimum distribution RMD.

Spreading taxes over time through a non-qualified stretch. A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan. Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium.

Ad Learn More about How Annuities Work from Fidelity. The answer is no. In the case of qualified annuities.

Get our free guide discover 6 sources of post-retirement income you should know. For instance in 2020 if you file your federal income tax return as an individual and your combined income is between 25000 and 34000 you may have to pay taxes on up to. If you receive pension or annuity payments before age 59½ you may be subject to an additional 10 tax on early distributions unless the distribution qualifies for an exception.

The prevailing wisdom is to pull money from taxable accounts. Regardless of your age if you. You may be surprised to learn that annuities 401 ks and even government pensions are taxed on the year we start receiving them.

This part of the annuity payment is not taxed over term of the annuity. Annuities are taxed at the time of withdrawal regardless of the. Based on Section 72 of the IRC Internal Revenue Code funds that are inside of an annuity can grow tax-deferred so there is no tax due on this gain that takes place inside of the account.

Learn some startling facts. Using the SARS tax tables and current primary rebate of R15 714 we calculate that you would have paid income tax of R106 725 if you didnt contribute any amounts to a. Annuities are a popular choice for investors who want to receive a steady income.

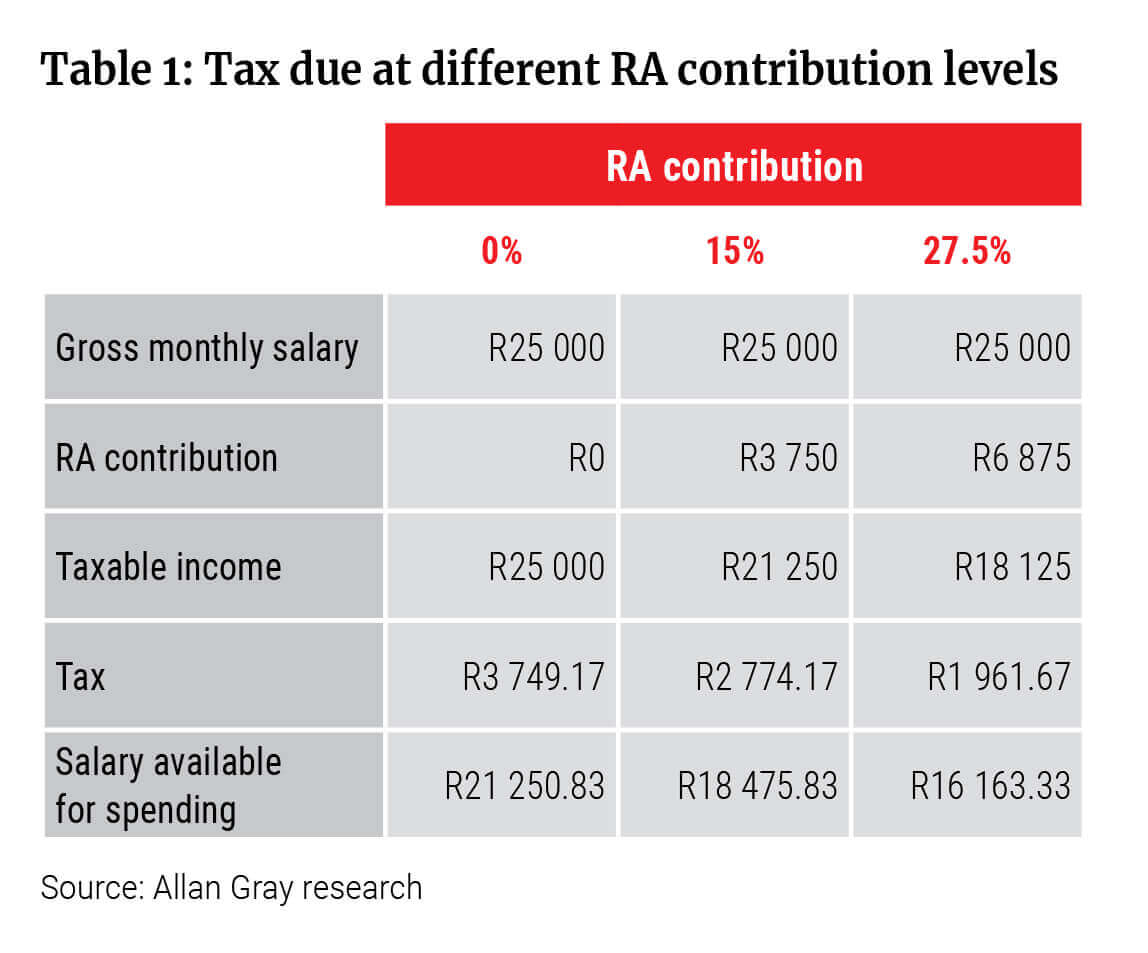

Contributions to an RA are tax-deductible up to 275 of remunerationtaxable income subject to an annual limit of R350000. If youre under 59 and 12 youll have to pay an early withdrawal penalty fee of 10 to the IRS on the full amount. Ad Its Time For A New Conversation About Your Retirement Priorities.

You can lower the taxable amount of your RMD by. Tax deferral refers to the act of postponing income taxes. Ad Annuities are often complex retirement investment products.

Individual taxpayers and corporations may defer income taxes by realizing less income during the year. Ad Download the free guide learn more about the 6 crucial post-retirement income streams. So your annual income from your 100000.

The investment returns earned in a retirement annuity fund is not taxed at the moment. Immediate annuities a powerful choice for reducing taxes. So you can claim.

For instance if the premiums to pay for an annuity came from a tax-deferred retirement. Ad Learn More about How Annuities Work from Fidelity. Sequencing withdrawals efficiently from different piles of savings can lead to a lower tax bill in the long run.

Annuitizing the inherited annuity. Ad Annuities are often complex retirement investment products. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

The investor who is also called an annuitant contributes money to the annuity in exchange for a. How can I reduce my RMD tax. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

You can save on your long-term tax liability by. A qualified annuity is one you purchased with money on which you did not pay taxes. 1 day agoHow to avoid paying taxes on an inherited annuity.

Tax Sale Tax Experts Tax Filing Online Company Tax Tax Income Tax Claim Tax Schedule Teaching Money Economics Lessons Financial Literacy Lessons

Video Do I Have To Purchase An Annuity At Retirement Maya On Money

Retirement Annuities Is The Tax Refund Worth It Sanlam Intelligence Retail

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Retirement Annuities Is The Tax Refund Worth It

Retirement Annuities Is The Tax Refund Worth It

Retirement Annuities Is The Tax Refund Worth It

Required Minimum Distributions Required Minimum Distribution Retirement Calculator Life Insurance Quotes

Beyond Section 80c 10 Ways To Save Taxes Tax Rules Tax Tax Deductions

Retirement Annuities Is The Tax Refund Worth It Sanlam Intelligence Retail

Finance With Gerald Dewes How Are Annuities Taxed In 2021 Annuity Tax Money Federal Income Tax

Reduce Your Tax Liability During This Retirement Annuity Season Moneyweb

Retirement Tax Incentives Supercharge The Fortunes Of Wealthy Americans Equitable Growth

Gary Shilling Falling Oil Prices Could End The Stock Market Rally Stock Market Crude Oils

Retirement Annuities Is The Tax Refund Worth It Sanlam Intelligence Retail

How Do Annuities Work Wealthfit Annuity Annuity Retirement Saving For Retirement

Annuity Annuity Retirement Cheating

Allan Gray Part 3 How To Maximise Tax Benefits Before The End Of The Tax Year

Ira Rollover Indicates To Move Loan From A Retirement Plan Such As A 401 K 403b Tax Sheltered Annuity Personal Budget Household Budget Budget Categories